In accounting, inventories refer to the goods that a company holds for sale in the normal course of business or goods that are used to produce goods to be sold. Managing inventories is an essential part of financial reporting for businesses as it can impact the financial statements, such as the income statement and balance sheet. Chapter 7 of accounting textbooks covers the topic of inventories, including valuation methods and disclosure requirements.

One important aspect of inventories is their valuation. Companies have different valuation methods to determine the cost of inventories, such as the first-in, first-out (FIFO) method, last-in, first-out (LIFO) method, and average cost method. These methods can have a significant impact on a company’s financial statements, as they affect the calculation of cost of goods sold and the value of ending inventory.

In addition to valuation, companies are also required to disclose certain information about their inventories. This includes the basis of valuation used, any significant estimates or assumptions made, and any inventory that is pledged as collateral. These disclosures provide transparency to investors and other stakeholders, allowing them to make informed decisions about the company’s financial position and performance.

In conclusion, Chapter 7 of accounting textbooks provides answers to various questions regarding inventories. It covers topics such as valuation methods, disclosure requirements, and the impact of inventories on financial statements. Understanding these concepts is crucial for businesses to accurately report their financial information and for stakeholders to make sound investment decisions.

Accounting Chapter 7 Inventories Answers

In Chapter 7 of accounting, the focus is on inventories and the different accounting methods used to track and value them. One of the main questions addressed in this chapter is how to determine the cost of inventory.

There are several methods available for calculating the cost of inventory, including the specific identification method, the first-in, first-out (FIFO) method, the last-in, first-out (LIFO) method, and the weighted average method. Each method has its own advantages and disadvantages, and the choice of method can have significant impact on the financial statements of a company.

The specific identification method involves keeping track of the cost of each individual item in inventory. This method is often used for items that have unique characteristics or high value. The FIFO method assumes that the first items purchased are the first ones sold, while the LIFO method assumes that the last items purchased are the first ones sold. The weighted average method calculates the cost of inventory based on the average cost of all the items in stock.

Another key question addressed in this chapter is how to account for any inventory losses or write-offs. If the market value of inventory drops below its cost, companies must record a loss on the financial statements. This can be done by adjusting the inventory account and recognizing the loss as an expense. Inventory write-offs may also occur if items become damaged, obsolete, or unsaleable. In these cases, the cost of the inventory is removed from the books and recognized as a loss on the financial statements.

Overall, Chapter 7 of accounting provides answers to the various questions and challenges that companies face when dealing with inventories. It is important for businesses to carefully consider the accounting methods used to track and value their inventory, as well as to properly account for any losses or write-offs that may occur. By doing so, companies can ensure that their financial statements accurately reflect the value of their inventories and the overall financial health of the business.

Understanding Inventories

Inventories play a crucial role in the field of accounting as they represent one of the largest assets for many businesses. The concept of inventories refers to the goods that a company holds for sale in the ordinary course of its business operations. These can include raw materials, work in progress, and finished goods.

Types of Inventories: There are several types of inventories that businesses typically have:

- Raw materials: These are the basic materials that are used in the production process and have not yet been transformed into finished goods.

- Work in progress: Also known as partially completed goods, work in progress includes products that are in the process of being manufactured but are not yet finished.

- Finished goods: These are the final products that have been completed and are ready to be sold to customers.

- Maintenance, repair, and operations (MRO) supplies: These are the materials and supplies that are used to support the production process or to maintain the company’s facilities and equipment.

Inventory Valuation: It is important for companies to accurately determine the value of their inventories in order to properly report their financial results. One method of valuation is the cost method, which values inventories at their historical cost. Another method is the lower of cost or market method, where inventories are valued at the lower of their cost or their net realizable value.

Inventory Management: Effective inventory management is crucial for businesses to minimize carrying costs, avoid stockouts, and ensure the availability of products to meet customer demand. This involves activities such as forecasting demand, setting optimal reorder points and order quantities, and implementing inventory control systems.

Types of Inventories

Inventories are one of the key components of a company’s assets and are categorized into different types based on their nature and purpose. The types of inventories commonly found in accounting include:

- Raw materials: These are the basic materials and components that are used in the production process but have not been transformed yet. Examples include steel, wood, and plastic.

- Work-in-progress: This inventory category includes partially completed goods that are still in the production process. These goods have undergone some transformation but are not yet finished products. Examples include partially assembled cars in an automobile manufacturing plant.

- Finished goods: These are completed products that are ready for sale and delivery to customers. Examples include packaged food items, electronics, and clothing.

- Merchandise: This inventory category includes goods that are purchased by a company for resale without undergoing any further processing. It includes items like clothing, electronics, and books that are bought by retailers and resold to consumers.

- Supplies: These are materials that a company uses in its day-to-day operations but do not become a part of the final product. Examples include office supplies, cleaning materials, and maintenance items.

Each type of inventory requires different accounting methods and considerations. Proper management of inventories is crucial for companies to ensure efficient operations, timely delivery of products, and accurate financial reporting.

FIFO Method

The FIFO (First-In, First-Out) method is one of the commonly used inventory valuation methods in accounting. Under this method, the inventory that is purchased or produced first is assumed to be sold first. As a result, the cost of the earliest purchases is allocated to the cost of goods sold (COGS), while the cost of the most recent purchases remains in the ending inventory.

When using the FIFO method, the cost of the earliest purchases is matched with the revenue from the corresponding sales, which provides a more accurate representation of the current value of inventory. This method is especially useful when the prices of goods are increasing over time, as it results in higher ending inventory values and lower COGS compared to other methods.

- Advantages of the FIFO Method:

1. It provides a more accurate reflection of the current value of inventory, as it values ending inventory at the most recent costs.

2. It is logical and intuitive, as it assumes that the oldest inventory is sold first.

3. It is useful in industries where the prices of goods are increasing, as it results in lower COGS and higher ending inventory values.

- Disadvantages of the FIFO Method:

1. It may result in higher income taxes, as the higher ending inventory values can lead to increased profits.

2. It does not reflect the actual physical movements of inventory, as it assumes that the oldest inventory is sold first regardless of the actual order of sales.

In conclusion, the FIFO method is a widely used inventory valuation method that provides a more accurate reflection of the current value of inventory. Its logical and intuitive approach makes it a preferred method for many companies, especially in industries where the prices of goods are increasing. However, it is important to consider the potential disadvantages, such as higher income taxes and the discrepancy between actual inventory movements and the assumed order of sales.

LIFO Method

The LIFO (Last-In, First-Out) method is an inventory valuation method that assumes that the most recently acquired inventory is sold first. Under the LIFO method, the cost of goods sold is calculated by multiplying the quantity of inventory sold by the cost of the most recent purchases. This method is based on the assumption that the cost of inventory tends to increase over time, so the most recent purchases are deemed to have a higher cost.

Using the LIFO method can have tax benefits because it typically results in a lower reported income and, therefore, lower tax liability. However, it may not accurately reflect the actual flow of goods in some industries or businesses where the most recent purchases may not be the first to be sold. For example, industries such as electronics or fashion may face obsolescence or seasonality, leading to different inventory flow patterns.

The LIFO method can also lead to increased inventory carrying costs, as older inventory that is not sold continues to be valued at older, lower costs. Additionally, the LIFO method can make financial statements more volatile, as changes in the cost of goods sold can have a significant impact on net income and financial ratios.

Overall, the LIFO method is a widely used inventory valuation method, particularly in industries with rising inventory costs. However, it is important for businesses to consider the specific characteristics of their industry and the impact the LIFO method may have on their financial statements and tax obligations.

Weighted Average Method

The weighted average method is a cost flow assumption that is commonly used in inventory accounting. Under this method, the cost of goods available for sale is divided by the total units of inventory to calculate a weighted average cost per unit. This average cost per unit is then used to assign costs to the units sold and the ending inventory.

To calculate the weighted average cost per unit, the cost of each item in inventory is multiplied by its respective quantity and then summed together. This total cost is then divided by the total quantity of inventory. The resulting weighted average cost per unit is used to allocate costs when units are sold or remaining in inventory.

The weighted average method is particularly useful when dealing with large quantities of similar items that have similar costs. It smoothens out the impact of price fluctuations by taking into account both the new and old costs of inventory. Additionally, it is relatively simple to calculate and is commonly used in industries such as manufacturing, retail, and distribution.

The weighted average method is advantageous in situations where it is not practical or cost-effective to track each individual item’s cost separately. It provides a reasonable estimate of cost and allows for a more accurate determination of profitability. However, it may not be suitable in scenarios where individual items have significantly different costs or when there are large price fluctuations.

In conclusion, the weighted average method is a commonly used cost flow assumption in inventory accounting. It calculates a weighted average cost per unit by dividing the cost of goods available for sale by the total units of inventory. This method is advantageous when dealing with large quantities of similar items and provides a reasonable estimate of cost. However, it may not be suitable in situations with significantly different costs for individual items or when there are large price fluctuations.

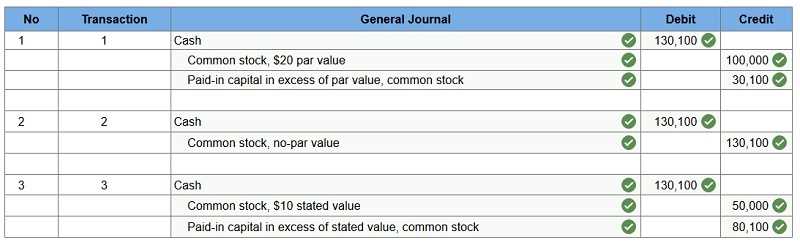

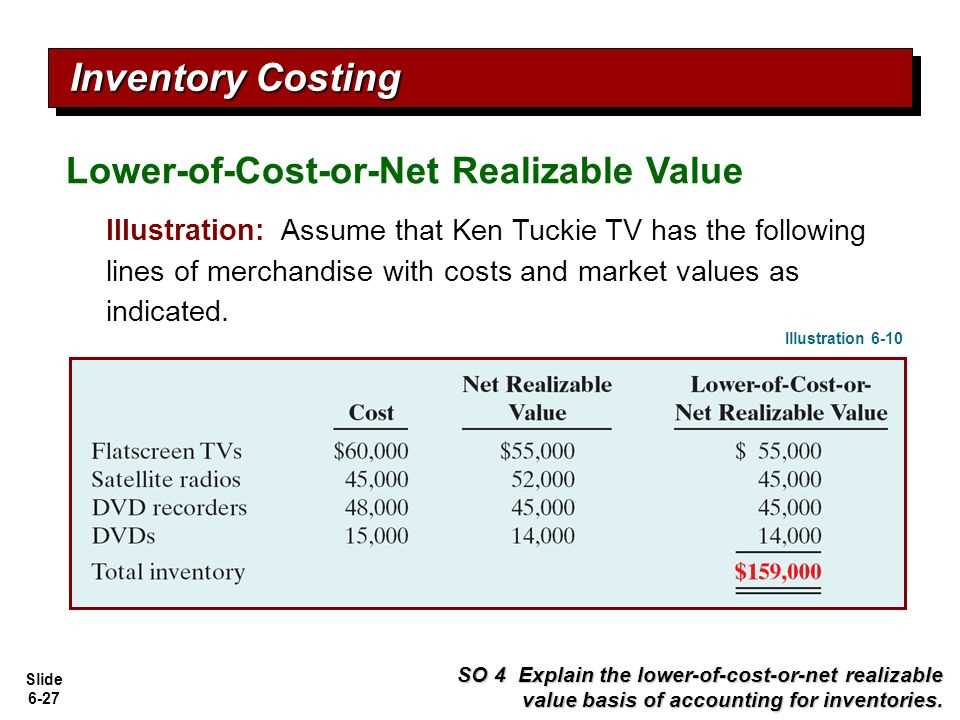

Lower of Cost or Market (LCM)

In accounting, the lower of cost or market (LCM) is a method used to value inventories. This method requires companies to compare the cost of their inventory with its market value and use the lower of the two as the valuation for financial reporting purposes. The LCM rule helps ensure that inventories are not overvalued in the balance sheet and that any losses in value are recognized in a timely manner.

Under the LCM method, the cost of inventory is determined using one of the accepted accounting methods, such as the first-in, first-out (FIFO) or weighted average cost method. The market value of inventory, on the other hand, is typically defined as the replacement cost or net realizable value, whichever is lower.

Once the cost and market values are determined, companies compare the two and select the lower value as the inventory valuation. If the cost exceeds the market value, a write-down is necessary to reduce the inventory value to its market value. This write-down is recorded as an expense on the income statement and reduces the inventory value on the balance sheet.

It is important for companies to regularly assess the valuation of their inventory using the LCM method to ensure that any declines in value are properly recognized. By applying the LCM rule, companies can accurately reflect the economic value of their inventory and avoid overstatement of assets on the balance sheet.

Inventory Costing Methods Comparison

Choosing the right inventory costing method is crucial for businesses as it directly impacts the reported value of their inventories and, consequently, their financial statements. There are several inventory costing methods available, including specific identification, first-in, first-out (FIFO), weighted average, and last-in, first-out (LIFO). Each method has its own advantages and disadvantages, and businesses must carefully consider their specific needs before selecting the most appropriate method.

Specific identification is the most precise inventory costing method as it assigns specific costs to each individual item based on its unique identifier. This method is typically used in industries where the inventory consists of high-value items with distinguishable features, such as jewelry or luxury cars. However, it can be impractical or impossible to use this method for businesses with a large number of low-value or indistinguishable items.

FIFO is a widely used inventory costing method that assumes the first items purchased or produced are the first ones sold. FIFO results in the assumption that the cost of ending inventory is closer to current market prices since it is based on more recent purchases. This method is advantageous in industries where the cost of inventory is increasing over time, as it leads to a higher ending inventory value and lower cost of goods sold.

Weighted average is a simpler inventory costing method that calculates the average cost of all items in inventory. It is ideal for businesses that have homogeneous inventories and where the cost of goods fluctuates significantly. Weighted average smoothes out the impact of varying costs and provides a more stable value for ending inventory and cost of goods sold.

LIFO is an inventory costing method that assumes the last items purchased or produced are the first ones sold. LIFO is advantageous for businesses in periods of rising prices, as it results in a lower ending inventory value and higher cost of goods sold. However, LIFO can lead to the undesirable effect of outdated costs being assigned to the ending inventory and may not accurately reflect current market prices.