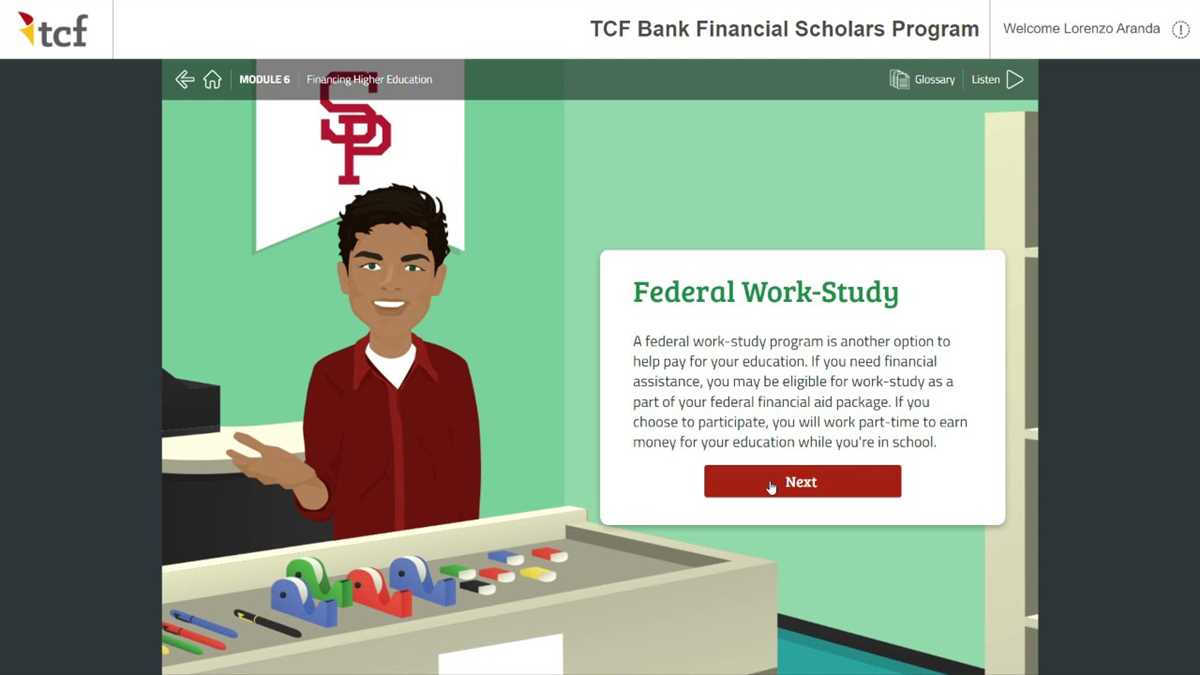

Learning how to save money is an essential skill for financial success. The Everfi Savings Module provides individuals with the necessary knowledge and tools to effectively manage their savings. In this module, participants learn about the importance of saving money, different types of savings accounts, and strategies for reaching their financial goals.

One of the key lessons in the Everfi Savings Module is the concept of compound interest. Participants learn how compound interest can work for them by allowing their savings to grow over time. They also discover the power of starting to save early and consistently, as well as the benefits of automated savings options.

Throughout the module, participants are presented with real-life scenarios and interactive exercises to reinforce their understanding of savings concepts. They are challenged to evaluate their own spending habits and identify areas where they can cut back in order to save more. Additionally, participants are introduced to the concept of setting SMART financial goals and creating a plan to achieve them.

By completing the Everfi Savings Module, individuals gain the knowledge and confidence to make informed financial decisions and take control of their savings. They learn practical strategies for building an emergency fund, saving for major expenses like a home or car, and planning for retirement. With the ever-increasing importance of financial literacy, the Everfi Savings Module provides a valuable resource for individuals of all ages and backgrounds.

Everfi Savings Module Answers

The Everfi Savings Module provides valuable information and resources to help individuals understand and improve their saving habits. By completing the module and understanding the answers to its questions, individuals can gain a better understanding of saving strategies, budgeting techniques, and the importance of setting financial goals.

One of the answers and concepts covered in the Everfi Savings Module is the difference between needs and wants. It teaches individuals to distinguish between essential expenses, such as food and housing, and non-essential expenses, such as entertainment and luxury purchases. By prioritizing needs over wants, individuals can allocate more money towards savings and long-term financial security.

The module also covers the concept of interest and its impact on savings. It explains how interest is earned on savings accounts and how compound interest can help savings grow over time. By understanding the power of compound interest, individuals are encouraged to start saving early and regularly to take advantage of its benefits.

Additionally, the Everfi Savings Module emphasizes the importance of creating a realistic budget and sticking to it. It provides tips and tools for tracking expenses, setting savings goals, and making informed financial decisions. By following a budget and regularly reviewing and adjusting it, individuals can effectively manage their money and make progress towards their savings goals.

Understanding the Importance of Saving Money

Many people underestimate the importance of saving money. It is not just about setting aside a portion of your income for a rainy day; saving money can have a wide range of benefits and can impact various aspects of your life.

Financial security: Saving money provides you with a sense of financial security. It allows you to have a safety net in case of emergencies or unexpected expenses. Having money saved up can help you navigate through tough times without going into debt or relying on credit cards.

Goal achievement: Saving money can help you achieve your goals faster. Whether it’s buying a house, starting a business, or going on a dream vacation, having savings can provide you with the necessary funds to make your dreams a reality.

Opportunities and flexibility: Saving money can bring opportunities and flexibility in your life. Having savings can give you the freedom to take advantage of investment opportunities, explore new career paths, or make major life changes without feeling financially constrained.

Peace of mind: Knowing that you have money saved up can bring you peace of mind. It reduces financial stress and allows you to focus on other aspects of your life, such as personal growth, family, and hobbies.

Building wealth: Saving money is the first step towards building wealth. By consistently saving and investing, you can grow your savings over time and potentially increase your net worth. Saving money can help you build a strong financial foundation for the future.

In conclusion, saving money is not just a good financial habit; it is a crucial step towards achieving financial security, reaching your goals, and gaining overall peace of mind in life. Start saving today and reap the benefits in the long run.

How to Set Savings Goals

Saving money is an important financial habit that can help set you up for future success. One of the key factors in successful saving is setting goals. By setting clear and attainable goals, you can stay motivated and focused on your saving journey.

1. Identify your financial objectives: Start by determining why you want to save money. Are you saving for a specific purchase, like a new car or a vacation? Or are you saving for long-term goals, such as retirement or a down payment on a house? Identifying the purpose of your savings will help you determine how much you need to save and how long it will take to reach your goals.

2. Set SMART goals: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. When setting savings goals, make sure they meet these criteria. For example, instead of saying “I want to save money,” a SMART goal would be “I want to save $10,000 for a down payment on a house within two years.” This goal is specific, measurable, achievable, relevant to your long-term plans, and has a clear timeline.

3. Break down your goals: Big savings goals can feel overwhelming, so it’s important to break them down into smaller, more manageable steps. For example, if your goal is to save $10,000, break it down into monthly or weekly targets. This will make your savings journey more attainable and allow you to track your progress along the way.

4. Create a budget: A budget is a crucial tool for successful savings. It helps you understand your income, expenses, and how much you can realistically save each month. Analyze your spending habits and identify areas where you can cut back or save more. By sticking to a budget, you’ll have a better chance of reaching your savings goals.

5. Automate your savings: One of the easiest ways to save money is to automate your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you won’t have to remember to save, and you’ll be less tempted to spend the money.

Remember, setting and achieving savings goals takes time and discipline. Stay committed to your goals, track your progress regularly, and celebrate your accomplishments along the way. By following these steps, you’ll be well on your way to building a solid financial future.

Strategies for Building a Savings Habit

Saving money is an important habit that can help you achieve financial stability and reach your goals. By following a few strategies, you can build a savings habit that will benefit you in the long run.

1. Set clear savings goals: Start by defining your savings goals. Whether it’s saving for a down payment on a house or building an emergency fund, having a specific target in mind will motivate you to save.

2. Create a budget: Take a close look at your income and expenses to create a budget. This will help you identify areas where you can cut back and allocate more money towards your savings goals.

3. Automate your savings: Set up automatic transfers from your checking account to a savings account. This way, a portion of your income will be saved before you have a chance to spend it.

4. Track your progress: Regularly review your savings account to see how close you are to reaching your goals. This will not only give you a sense of accomplishment but also help you adjust your saving strategy if needed.

5. Limit impulse spending: Prioritize your needs over wants and resist the urge to make impulsive purchases. By avoiding unnecessary expenses, you’ll have more money to save.

6. Research savings options: Explore different savings accounts, such as high-yield savings accounts or certificates of deposit, to find the best option for your needs. Consider the interest rates, fees, and accessibility before making a decision.

7. Stay motivated: Keep your savings goals in mind and remind yourself of the benefits of saving. Whether it’s financial freedom or being prepared for emergencies, staying motivated will help you stick to your savings habit.

By implementing these strategies, you can establish a strong savings habit that will lead to financial security and peace of mind.

Exploring Different Types of Savings Accounts

In today’s financial world, there are several different types of savings accounts available to individuals. These accounts offer varying features and benefits, allowing savers to choose the account that best fits their needs. Understanding the different types of savings accounts can help individuals make informed financial decisions and effectively grow their savings.

One type of savings account is a traditional savings account. This type of account is typically offered by banks and credit unions and allows individuals to save money while earning interest. Traditional savings accounts often have a low minimum balance requirement and provide easy access to funds. This makes them a popular choice for individuals who want a simple and accessible way to save money.

Types of Savings Accounts

- Certificate of Deposit (CD): A certificate of deposit is a savings account that typically offers a higher interest rate than a traditional savings account. However, in exchange for the higher rate, savers agree to leave their money in the account for a specific period of time, known as the term. CDs are a good option for individuals who have a specific savings goal and don’t need immediate access to their funds.

- Money Market Account: A money market account is a type of savings account that typically requires a higher minimum balance than a traditional savings account. In return for the higher balance requirement, money market accounts usually offer a higher interest rate. They also often come with additional features like check-writing privileges. Money market accounts are a good option for individuals who want to earn a higher interest rate on their savings while still having some liquidity.

- High-Yield Savings Account: A high-yield savings account is similar to a traditional savings account but offers a higher interest rate. These accounts are typically offered by online banks and often have competitive interest rates compared to traditional brick-and-mortar banks. High-yield savings accounts are a good choice for individuals who want to earn a higher return on their savings without sacrificing accessibility.

By exploring the different types of savings accounts available, individuals can find the account that best aligns with their financial goals and preferences. Whether they prioritize accessibility, a higher interest rate, or specific features, there is a savings account out there to help individuals grow their savings effectively.

Managing and Tracking Your Savings Progress

Managing and tracking your savings progress is an essential part of achieving your financial goals. By keeping a close eye on your savings, you can ensure that you are making progress towards your objectives and make adjustments as needed.

Set Clear Goals: Before you can effectively manage and track your savings, you need to set clear goals. Determine what you are saving for, whether it’s a short-term goal like a vacation or a long-term goal like retirement. Having specific objectives in mind will help you stay focused and motivated.

Create a Budget: A budget is a powerful tool for managing your savings. Take the time to evaluate your income and expenses to determine how much you can realistically save each month. Allocate a portion of your income to savings and stick to it. By following a budget, you can ensure that your savings progress stays on track.

Monitor Your Savings: Regularly checking your savings account balance is crucial for tracking your progress. Set a routine to review your account statement and see how much you have saved. This will allow you to see if you are meeting your savings goals or if adjustments need to be made.

Track Your Spending: Along with monitoring your savings, it’s important to track your spending habits. Keep a record of your expenses to identify areas where you may be overspending. By making adjustments to your spending habits, you can free up more money to put towards savings.

Utilize Technology: Take advantage of technology to manage and track your savings progress. Many banks offer online and mobile banking options that allow you to easily monitor your accounts and set up automatic transfers to your savings. Additionally, there are various personal finance apps available that can help you track your spending, set savings goals, and provide financial insights.

Celebrate Milestones: Celebrate your savings milestones along the way. When you reach a certain amount saved or achieve a specific goal, reward yourself. Recognizing and celebrating your progress can help you stay motivated and continue working towards your financial objectives.

Overcoming Challenges to Saving Money

Saving money can be a challenging endeavor, but it is essential for financial stability and future goals. There are several common challenges that individuals face when trying to save money and strategies to overcome them.

1. Limited income: One of the biggest challenges to saving money is having a limited income. When expenses exceed income, it can be difficult to set aside money for savings. To overcome this challenge, individuals can consider finding additional sources of income, such as part-time jobs or freelance work. They can also evaluate their expenses and identify areas where they can reduce spending to free up more money for savings.

2. Impulse buying: Impulse buying is another major obstacle to saving money. It is easy to give in to the temptation of instant gratification and make unplanned purchases. To overcome this challenge, individuals should practice self-discipline by creating a budget and sticking to it. They can also delay gratification by waiting for a certain period before making non-essential purchases, giving themselves time to reconsider and prioritize saving over immediate wants.

3. Lack of financial literacy: Many people struggle to save money because they lack financial literacy. They may not have the necessary knowledge and skills to manage their finances effectively. To overcome this challenge, individuals can educate themselves by taking financial literacy courses or seeking guidance from financial advisors. By understanding important concepts such as budgeting, investing, and compound interest, they can make informed decisions and develop effective saving strategies.

4. Unexpected expenses: Unexpected expenses can derail savings plans. Whether it is a medical emergency or a car repair, unforeseen costs can quickly deplete savings. To overcome this challenge, individuals should establish an emergency fund. They can set aside a portion of their income regularly in a separate savings account to cover unexpected expenses. It is important to continuously replenish the emergency fund to ensure financial security.

5. Peer pressure and societal expectations: Peer pressure and societal expectations can also hinder saving efforts. People may feel the need to keep up with their peers or meet societal standards, even if it means sacrificing their savings goals. To overcome this challenge, individuals should focus on their personal financial goals and priorities. They should communicate their intentions with their loved ones and seek support and understanding. By staying true to their long-term goals, they can resist the influence of external pressures and save effectively.

| Challenge | Strategy |

|---|---|

| Limited income | Seek additional sources of income and reduce expenses |

| Impulse buying | Create a budget, delay gratification, and prioritize saving |

| Lack of financial literacy | Get educated through courses or seek guidance from financial advisors |

| Unexpected expenses | Establish an emergency fund and regularly replenish it |

| Peer pressure and societal expectations | Focus on personal financial goals, communicate intentions, and seek support |